Those Receiving COBRA Coverage Must Sign Up for Medicare Part B at 65 to Avoid Penalty

Advocates are seeing an increase in the number of individuals who have delayed enrolling in Medicare Part B under the mistake...

Read more Elder Law Answers

Elder Law Answers

Medicare beneficiaries often buy “Medigap” insurance that pays for many of regular Medicare’s deductibles and copayments. But as a result of legislation just passed by Congress, starting in 2020 Medigap plans will no longer be allowed to offer coverage of the Medicare Part B deductible, which is currently $203 (in 2021). However, current Medigap policyholders and those buying policies before 2020 will still be eligible for the deductible coverage after that date.

Medicare beneficiaries often buy “Medigap” insurance that pays for many of regular Medicare’s deductibles and copayments. But as a result of legislation just passed by Congress, starting in 2020 Medigap plans will no longer be allowed to offer coverage of the Medicare Part B deductible, which is currently $203 (in 2021). However, current Medigap policyholders and those buying policies before 2020 will still be eligible for the deductible coverage after that date.

The change is an effort to help pay for so-called “doc fix” legislation that overhauls the way Medicare pays doctors and that is expected to cost $200 billion over 10 years. Medicare Part B covers doctor visits and other outpatient care, and currently Medigap plans C and F offer coverage of the Part B deductible. The reasoning behind making Medicare beneficiaries pay the deductible themselves is that it will cause them to think twice before going to a doctor and perhaps costing the Medicare system unnecessary money.

Local Elder Law Attorneys in Your City

Some argue, however, that if the change prompts beneficiaries to forego needed medical care, they may simply require more expensive care later, costing Medicare more in the end. Critics also say that the change will encourage more beneficiaries to abandon regular Medicare and join Medicare Advantage plans, which will still be able to cover the deductible.

In addition to the Medigap change, affluent seniors will have to pay higher Part B premiums as a result of the legislation. Starting in 2018, individuals with incomes between $133,500 and $214,000 (or twice these figures for couples) will pay more; details here. And the regular Part B premium will rise faster than under current law as a result of the "doc fix" legislation.

For details on the changes from Reuters, click here.

For the Center for Medicare Advocacy's analysis of the "doc fix" bill's impact on Medicare beneficiaries, click here.

For more about Medigap plans, click here.

For more about Medicare, click here

Advocates are seeing an increase in the number of individuals who have delayed enrolling in Medicare Part B under the mistake...

Read moreIf you are paying for your own insurance, you may think you do not need to sign up for Medicare when you turn 65. However, no...

Read moreThe Centers for Medicare and Medicaid has announced the 2013 Medicare premiums, deductibles, and coinsurances . . .

Read moreIn addition to nursing home care, Medicaid may cover home care and some care in an assisted living facility. Coverage in your state may depend on waivers of federal rules.

READ MORETo be eligible for Medicaid long-term care, recipients must have limited incomes and no more than $2,000 (in most states). Special rules apply for the home and other assets.

READ MORESpouses of Medicaid nursing home residents have special protections to keep them from becoming impoverished.

READ MOREIn addition to nursing home care, Medicaid may cover home care and some care in an assisted living facility. Coverage in your state may depend on waivers of federal rules.

READ MORETo be eligible for Medicaid long-term care, recipients must have limited incomes and no more than $2,000 (in most states). Special rules apply for the home and other assets.

READ MORESpouses of Medicaid nursing home residents have special protections to keep them from becoming impoverished.

READ MORECareful planning for potentially devastating long-term care costs can help protect your estate, whether for your spouse or for your children.

READ MOREIf steps aren't taken to protect the Medicaid recipient's house from the state’s attempts to recover benefits paid, the house may need to be sold.

READ MOREThere are ways to handle excess income or assets and still qualify for Medicaid long-term care, and programs that deliver care at home rather than in a nursing home.

READ MORECareful planning for potentially devastating long-term care costs can help protect your estate, whether for your spouse or for your children.

READ MOREIf steps aren't taken to protect the Medicaid recipient's house from the state’s attempts to recover benefits paid, the house may need to be sold.

READ MOREThere are ways to handle excess income or assets and still qualify for Medicaid long-term care, and programs that deliver care at home rather than in a nursing home.

READ MOREMost states have laws on the books making adult children responsible if their parents can't afford to take care of themselves.

READ MOREApplying for Medicaid is a highly technical and complex process, and bad advice can actually make it more difficult to qualify for benefits.

READ MOREMedicare's coverage of nursing home care is quite limited. For those who can afford it and who can qualify for coverage, long-term care insurance is the best alternative to Medicaid.

READ MOREMost states have laws on the books making adult children responsible if their parents can't afford to take care of themselves.

READ MOREApplying for Medicaid is a highly technical and complex process, and bad advice can actually make it more difficult to qualify for benefits.

READ MOREMedicare's coverage of nursing home care is quite limited. For those who can afford it and who can qualify for coverage, long-term care insurance is the best alternative to Medicaid.

READ MOREDistinguish the key concepts in estate planning, including the will, the trust, probate, the power of attorney, and how to avoid estate taxes.

READ MORELearn about grandparents’ visitation rights and how to avoid tax and public benefit issues when making gifts to grandchildren.

READ MOREUnderstand when and how a court appoints a guardian or conservator for an adult who becomes incapacitated, and how to avoid guardianship.

READ MOREWe need to plan for the possibility that we will become unable to make our own medical decisions. This may take the form of a health care proxy, a medical directive, a living will, or a combination of these.

READ MOREDistinguish the key concepts in estate planning, including the will, the trust, probate, the power of attorney, and how to avoid estate taxes.

READ MORELearn about grandparents’ visitation rights and how to avoid tax and public benefit issues when making gifts to grandchildren.

READ MOREUnderstand when and how a court appoints a guardian or conservator for an adult who becomes incapacitated, and how to avoid guardianship.

READ MOREWe need to plan for the possibility that we will become unable to make our own medical decisions. This may take the form of a health care proxy, a medical directive, a living will, or a combination of these.

READ MOREUnderstand the ins and outs of insurance to cover the high cost of nursing home care, including when to buy it, how much to buy, and which spouse should get the coverage.

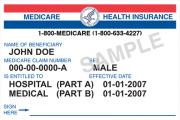

READ MORELearn who qualifies for Medicare, what the program covers, all about Medicare Advantage, and how to supplement Medicare’s coverage.

READ MOREWe explain the five phases of retirement planning, the difference between a 401(k) and an IRA, types of investments, asset diversification, the required minimum distribution rules, and more.

READ MOREFind out how to choose a nursing home or assisted living facility, when to fight a discharge, the rights of nursing home residents, all about reverse mortgages, and more.

READ MOREUnderstand the ins and outs of insurance to cover the high cost of nursing home care, including when to buy it, how much to buy, and which spouse should get the coverage.

READ MOREWe explain the five phases of retirement planning, the difference between a 401(k) and an IRA, types of investments, asset diversification, the required minimum distribution rules, and more.

READ MOREFind out how to choose a nursing home or assisted living facility, when to fight a discharge, the rights of nursing home residents, all about reverse mortgages, and more.

READ MOREGet a solid grounding in Social Security, including who is eligible, how to apply, spousal benefits, the taxation of benefits, how work affects payments, and SSDI and SSI.

READ MORELearn how a special needs trust can preserve assets for a person with disabilities without jeopardizing Medicaid and SSI, and how to plan for when caregivers are gone.

READ MOREExplore benefits for older veterans, including the VA’s disability pension benefit, aid and attendance, and long-term care coverage for veterans and surviving spouses.

READ MOREGet a solid grounding in Social Security, including who is eligible, how to apply, spousal benefits, the taxation of benefits, how work affects payments, and SSDI and SSI.

READ MORELearn how a special needs trust can preserve assets for a person with disabilities without jeopardizing Medicaid and SSI, and how to plan for when caregivers are gone.

READ MOREExplore benefits for older veterans, including the VA’s disability pension benefit, aid and attendance, and long-term care coverage for veterans and surviving spouses.

READ MORE